A recent New York Times article identifies a fundamental problem in the pricing of medicines in our health care system today: It is difficult to determine what “cost” is for a medicine.

What a given pharmacy actually pays to stock a medicine in the pharmacy to sell may change from one order to the next based on a variety of factors. This is complicated by the fact that the amount a pharmacy is allowed to charge or what the pharmacy is paid for a medicine is determined by a contract between the pharmacy benefits manager (PBM) that manages the network of pharmacies (ex. Express Scripts, CVS/Caremark, Optum, etc.) and the pharmacy (Walgreens in the NYT article).

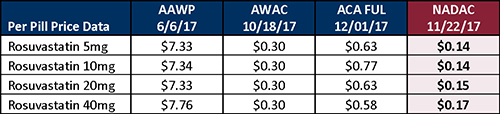

In the article’s example, the Walgreens pharmacy was allowed to charge $0.93 per pill for the cholesterol drug rosuvastatin – the network agreement between the PBM and Walgreens. In contrast, online Rx discounter Blink Health charged $0.51 per pill. But while Blink’s price was better, it was also able to secure a sizeable gross profit on this prescription. The data that follows is important in this determination.

- AAWP – Average of Average Wholesale Price

- AWAC – Average of Wholesale Acquisition Cost

- ACAFUL – Affordable Care Act Federal Upper Limit

- NADAC – National Average Daily Acquisition Cost

The NADAC price, in this case, is the price that matters and why Blink could sell at such a low cost and still make money. But how do employer health plans take advantage of this pricing approach for their plan members? We have the answer to the problem.

MedBen is launching a new Rx program that bypasses the industry standard of “AWP less discount and MAC pricing for generics” approach to drug pricing in favor of a “Cost Plus” basis of pricing.

The MedBen Rx program model will pay the pharmacy the average cost of the drug based on a proprietary national retail pharmacy survey (like NADAC, above) plus a dispensing fee that reflects the pharmacy services in filling a prescription. This method of pricing will provide MedBen groups with a pricing methodology that eliminates the “margin manipulation” that is possible in the current PBM AWP discount approach to pricing.

For more information on this money-saving pharmacy program, contact MedBen Vice President of Sales & Marketing Brian Fargus at 888-627-8683 or bfargus@medben.com.