In their continuing quest for bigger profits, major pharmacy benefit managers (PBMs) have adapted a new tactic: clever wordplay. What was once known as a “rebate” – a partial refund of the drug payment back to the plan – now goes by a variety of other terms, such as “administration fees,” “inflation protection” or “volume discounts.” And under these aliases, the refunds don’t go back to the plan… they go to the PBM.

Put another way… in the past decade, your rebate has become a “non-rebate.”

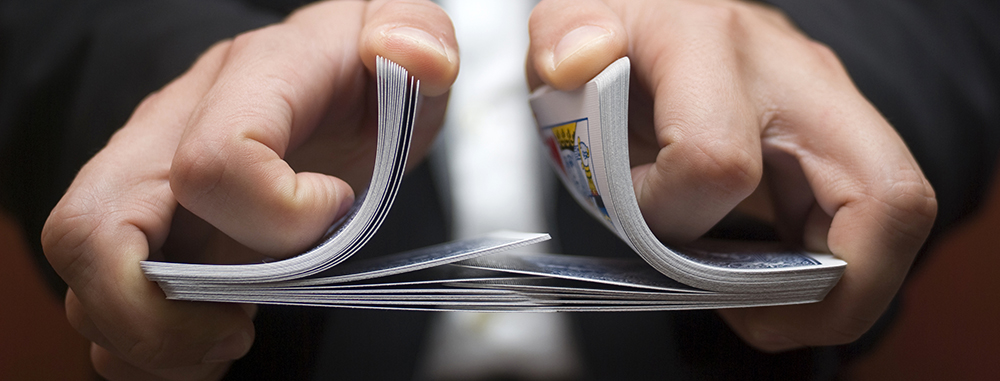

A recent Bloomberg article details the ways some PBMs are shuffling the deck. In addition to novel names, PBMs charge fees to drugmakers based on a percentage of a drug’s list price, rather than a flat rate… so higher-price medications translate to bigger PBM fees, even through the administrative work required is the same as a lower-cost drug. And invariably, those expensive medications find their way onto the PBM’s formulary.

Moreover, as the PBMs charge fees to both the PBM and the plan sponsor, they pocket profits from buyer and seller alike. Of course, the extra money the PBMs receive have to come from somewhere… and one guess where (or who) that is? By passing the “non-rebates” on to the PBMs, plan sponsors are seeing 50% or less of what they used to receive.

Formulary and pricing manipulation to ensure a bigger return are just two of the PBM games MedBen Rx discusses in its white paper. If you haven’t read it, we encourage you to do so.